cash accounting scheme

At the moment this is the Cash accounting scheme. Thanks 0 Replying to VCM.

The Cash Accounting And Annual Accounting Schemes Acca Taxation Tx Uk F6 Vat Lecture Part 6 Youtube

Create an entry with period during which the customer is on the VAT cash accounting scheme and select the VAT Cash Accounting Scheme checkbox.

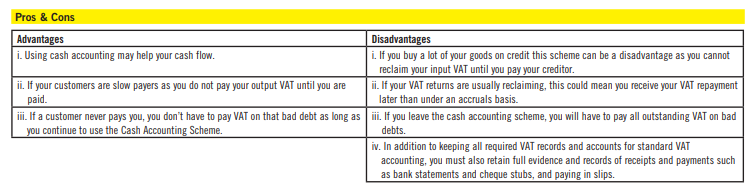

. Which businesses can use the cash accounting scheme. You can also reclaim VAT when you pay your suppliers for business purchases. You only pay the tax on sales when your customers have paid you.

Cash Accounting VAT Scheme. Note that this setting is mandatory for reporting and for. This is generally used by smaller businesses which do not make.

The Cash Accounting Scheme for VAT allows you to pay for or claim back your VAT only when the Invoice or Purchase has been paid rather than when they are issued. Simple cash accounts will not give a true picture of the business performance. Who can use the scheme.

The cash accounting scheme is aimed at smaller businesses so in order to be eligible your estimated VATable sales for the next 12 months must be no more than 135 million. Cash accounting is open to you if you are a registered trader with an expected taxable turnover not exceeding 1350000 in the next twelve months. However until there is a change in the law or the tax authorities opinion taxable persons can rely on the provisions of the German VAT Circular.

So I wonder what the consequence would be if we just report everything as cash accounting. You can use this scheme if your estimated. Authentidatede Auch KMU werden Nutzen aus dem Vorschlag ziehen da er die Verwendung vereinfachter Rechnungen einschließlich der für KMU besonders wichtigen Rechnungen über kleinere Beträge ermöglichen wird und die Mitgliedstaaten es den KMU dadurch.

The main conditions are that you should have made all necessary VAT returns and have made arrangements with HM RC to clear any arrears of VAT payments. Cash accounting does a good job of tracking cashflow but does a poor job of matching revenues earned with money laid out for expenses. You dont need to pay VAT until youve received payment yourself and if a customer doesnt pay you for any reason you dont have to pay VAT on that bad debt.

Businesses using the cash accounting scheme also need to bear in mind that input tax can only be recovered when they have paid the supplier. There is no VAT on these invoices anyway. This means that you will not have to pay GST until you have been paid by your customers.

Insofar as the supplier is subject to the cash accounting scheme this view is contrary to Union law. Cash accounting scheme Flat rate scheme Accounting software Standard accounting scheme Under the standard accounting scheme the amount you pay HMRC is the difference between the VAT amounts on your sales invoices and purchase invoices. The input VAT deduction upon provision of the supply with its pre.

When I have added a subbie invoice under the new DRC VAT rate it adds it to the VAt return based on payment date not invoice date. Under Union law input VAT must be deducted upon payment. They dont count sent invoices as income or bills as expenses until theyve been settled.

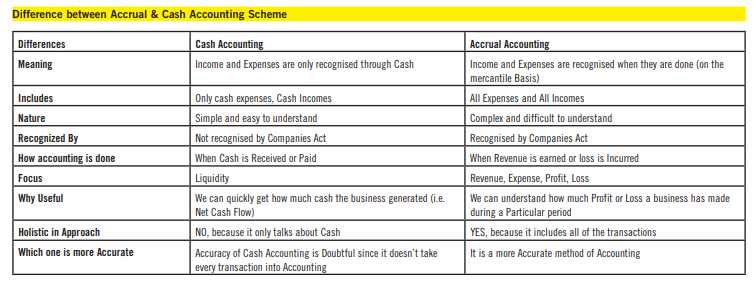

This differs from the normal rules where businesses use invoices as the basis for paying VAT to and recovering VAT from HMRC. The VAT cash accounting scheme is one of the most popular VAT schemes available offering some of the best cash flow benefits to small businesses especially given the ability to combine it with other VAT schemes. The VAT Cash Accounting Scheme CAS is different.

Businesses that use cash basis accounting recognise income and expenses only when money changes hands. The Cash Accounting VAT Scheme therefore differs from the Standard VAT Accounting Scheme under which VAT is recorded on the date of issuing or receiving a VAT invoice regardless of. Under the scheme businesses only have to account for output tax when payment is received.

Using cash accounting can be beneficial to a business in terms of cash flow as it will not be required. The screen for VAT cash accounting scheme is displayed if the business partner is assigned to a company code which is located in Portugal or has a plant abroad in Portugal. The United Kingdom obtained an extension of Decision 97375EC authorising it to extend the application of an opti onal cash accounting scheme for enterprises with a turnover below a certain ceiling whereby tax is assessed on the basis of.

What is cash basis accounting. The United Kingdom obtained an extension of Decision 97375EC authorising it to extend the application of an opti onal cash accounting scheme for enterprises with a turnover below a certain ceiling whereby tax is assessed on the basis of. SMEs to account for VAT on a cash basis under a cash accounting scheme.

Cash Accounting Scheme The Cash Accounting Scheme is designed to alleviate the cash flow of small businesses. This can help small businesses ensure that they have received the money from their customer before having to pay it across to HMRC. Cash accounting scheme The cash accounting scheme allows you to account for GST when you receive payment which is usually later and may be in a later return period.

Many translated example sentences containing cash accounting scheme Spanish-English dictionary and search engine for Spanish translations. The Cash Accounting Scheme is most beneficial for small businesses as it can help to improve cash flow especially if your customers are slow payers. Benefits of the VAT Cash Accounting scheme If you use the standard VAT scheme you account for any VAT you charge on goods and services according to the date you raise an invoice.

Once youve joined the scheme you can stay on it until your annual VATable sales exceed 16 million. The VAT Cash Accounting Scheme follows the principles of cash accounting meaning that income is recorded when it is received and expenses are recorded in the period they are paid. Despite the name cash basis accounting has nothing to do with the form of payment you receive.

You can get help with tax issues to determine if the Cash Accounting Scheme is best for your business. Heres an overview of the cash accounting scheme the advantages and disadvantages and how to apply to join. Cash Accounting Using the Cash Accounting Scheme you pay VAT when your customer pays you but you also need to consider that you cant reclaim VAT on your purchases until you have paid for them.

This scheme follows the principles of cash accounting and therefore considers the date payments are made rather than the date an invoice is issued. In order to offer credit and loans banks might require accounts to be prepared under GAAP. So every quarter you have to pay HMRC the balance of any VAT you have requested even if the invoices have yet to be paid and reach your bank account.

The Cash Accounting Scheme Pq Magazine

Cash Management And Vat Moore Smalley

What Is The Vat Cash Accounting Scheme Threshold

Filling Your Quarterly Vat Return Using The Cash Accounting Scheme Youtube

The Cash Accounting Scheme Pq Magazine

Invoice Vs Cash Accounting Uk Vat Schemes Simplified Freeagent

Uk Value Added Tax The Cash Accounting Scheme For Small Businesses Other

Cash Accounting Scheme Ppt Powerpoint Presentation Gallery Clipart Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

0 Response to "cash accounting scheme"

Post a Comment